Our Vision, Our Expertise: A Partnership for Success

Pioneering Fintech Solutions

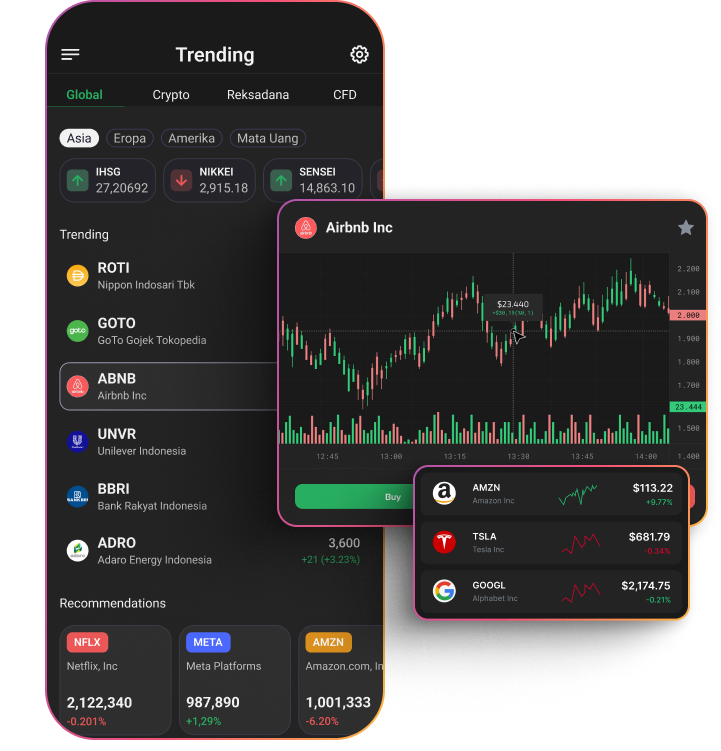

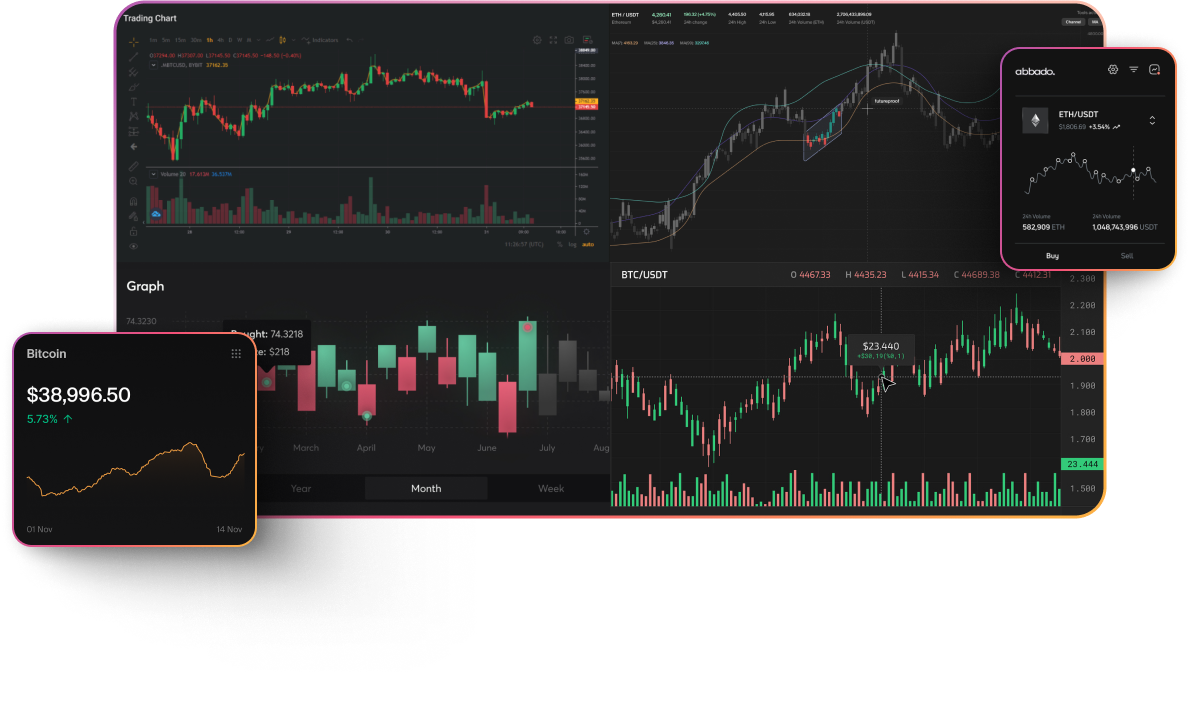

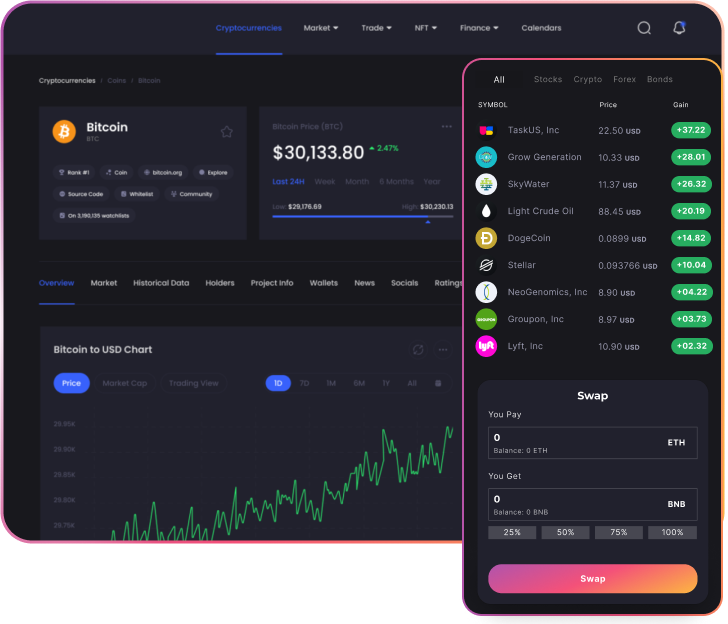

Stay ahead in the fast-evolving financial markets with Public/Algo innovative technology

WHY Public/Algo

Innovating for Tomorrow's Financial Markets

At Public/Algo, we specialize in creating powerful solutions for fintech industry applications that are designed for kick-starting, growing, and expanding financial services. Whether you're an established broker or established fintech entrepreneur, your success is our goal. We turn your dreams in to reality using cutting edge technology and expertise, plus a touch of magic inspired by you, of course. We believe in the potential of our algorithmic trading platform not only to overhaul your business standards, but to be integrated into global markets. Only then, will algorithmic trading advance into the future with our cutting edge technology that simplifies market access and use-ability.

Ready-to-Go Solution

Streamlined & Integrated

100% Regulations Compliant

Responsive & Flexible Design

Modular-Based Software

Customizations on Request

Fintech Solutions

Blockchain Technology

Payment Gateways

Financial Analytics

Crypto Trading

API Services

Trading Platforms

Mobile Payments

Regulatory Compliance

Investment Apps

Data Security

Cloud Banking

Cloud Banking

Risk Assessment

Mobile Payments

Regulatory Compliance

Investment Apps

Data Security

Cloud Banking

Cloud Banking

Risk Assessment

Fintech Solutions

Blockchain Technology

Payment Gateways

Financial Analytics

Crypto Trading

API Services

Trading Platforms

Mobile Payments

Regulatory Compliance

Investment Apps

Data Security

Cloud Banking

Cloud Banking

Risk Assessment

Fintech Solutions

Blockchain Technology

Payment Gateways

Financial Analytics

Crypto Trading

API Services

Trading Platforms

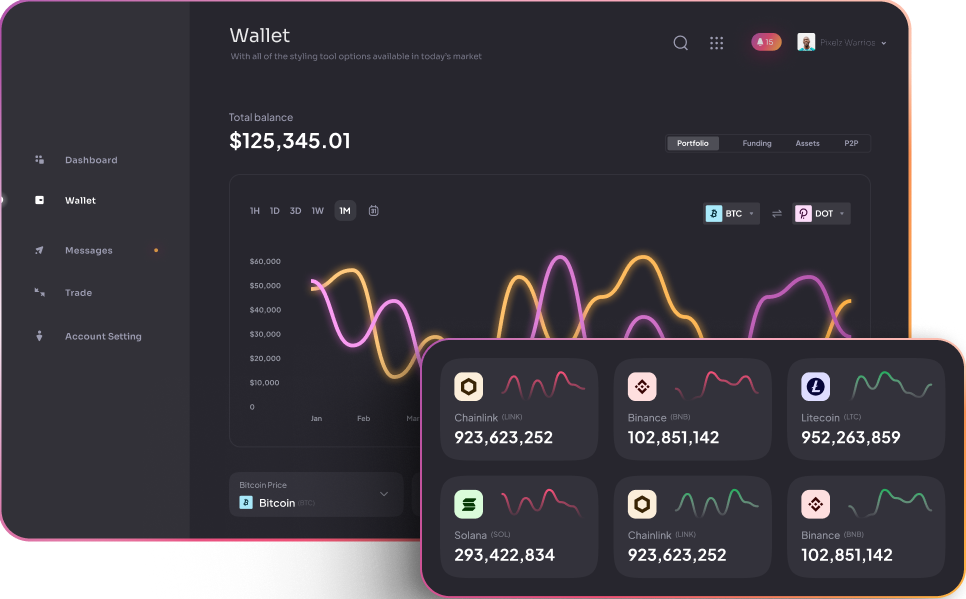

Solutions

Tailored Software Solutions that Power Financial Innovations

At Public/Algo, we understand the pulse of fintech. Our bespoke software and solution packages are designed to launch, enhance, and scale your financial services. Whether you're a broker or a burgeoning fintech startup, we're here to transform your vision into reality with cutting-edge technology, advanced algorithms and unwavering support.

End-to-end service from front to back office

State-of-the-art security and efficiency

Innovation-driven approach to trading

Ai powered text generator

Meet your new intelligent writing assistant.

Select an AI Platform and Input some basic information about your idea, brand, product, or service, and the AI would generate a unique, engaging piece of content in seconds.

Work with us

Your Journey withPublic/Algo

Our four-step path is tailored for efficiency, ensuring a smooth transition to leading-edge fintech solutions. Embrace a future where your business is not just enhanced but revolutionized.

Discover & Connect

Consultation & Customization

Implementation & Integration

Training & Support

Connect

Explore our fintech solutions online and initiate contact through our website or direct communication. Our team is ready to respond and begin our partnership journey.

Consult

Engage in a tailored consultation to discuss your needs and how our technology can support your goals. We'll design a custom solution just for you.

Implement

Our technical team leads a streamlined implementation and integration of our software into your operations, ensuring a seamless transition.

Support

Receive comprehensive training and ongoing support to maximize your platform's benefits, with our team always available for assistance.

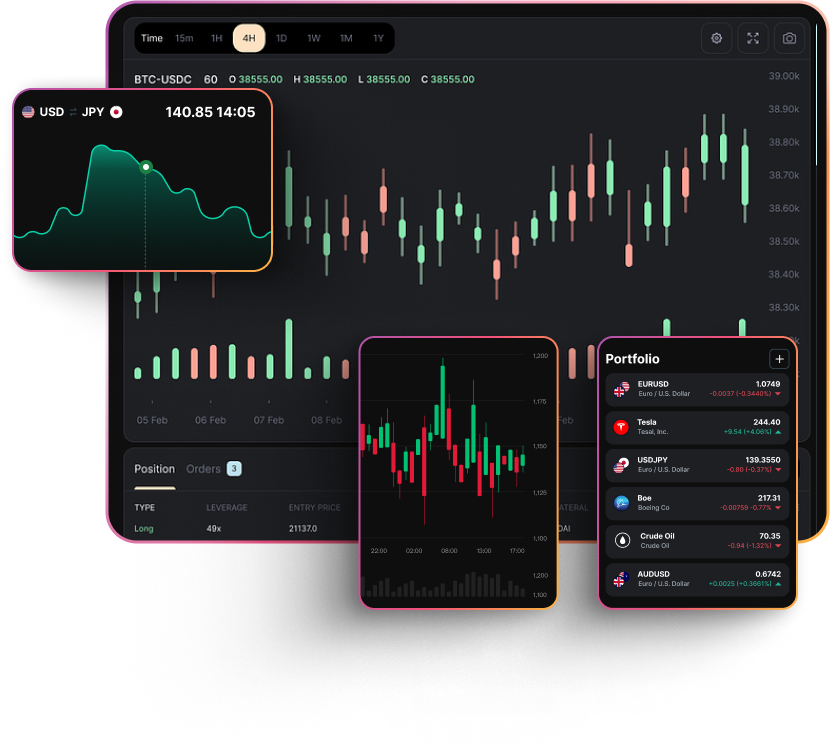

Unlock the Potential of Our Algo Trading Platform

Elevate trading strategies with our cutting-edge algorithms that ensure you're always a step ahead.

Streamlined Solutions for Brokerages

Experience unmatched efficiency with our comprehensive trading platform, designed to simplify every aspect of brokerage operations.

Future-Proof Your Financial Operations

Stay ahead in the fast-evolving financial markets with Public/Algo innovative technology, securing your success for years to come.

Your Potential: Unlocked

Revolutionizing Trading with Technology

Dive into the future where your success is empowered by groundbreaking algorithmic precision.

join us

Let's Scale Together

Slide to discover how your investment translates into partnership shares

Funds Provided

Shares Received

Connect

Explore our fintech solutions online and initiate contact through our website or direct communication. Our team is ready to respond and begin our partnership journey.

Consult

Engage in a tailored consultation to discuss your needs and how our technology can support your goals. We'll design a custom solution just for you.

Implement

Our technical team leads a streamlined implementation and integration of our software into your operations, ensuring a seamless transition.

Support

Receive comprehensive training and ongoing support to maximize your platform's benefits, with our team always available for assistance.

Monthly Spend Calculator

Envision The Scalability

Investment amount

number of shares

Users onboarded

trading volume generated

offices

year

why us

Build The Future of FinTech Together

Robust Market Position

BuildQapital stands at the forefront of the algorithmic trading technology space, offering investors a solid foothold in the rapidly growing fintech market.

Innovative Technology Platform

Our state-of-the-art trading solutions are designed to meet the evolving needs of the financial markets, ensuring long-term relevance and growth.

Expanding Trading Volumes

Through our specialized subsidiary, we've significantly increased trading volumes, demonstrating our capability to scale and deliver value.

Comprehensive Fintech Ecosystem

Our end-to-end solutions for brokerage firms highlight a holistic approach, from innovative trading platforms to efficient back-office operations.

Strong Growth Potential

The fintech industry continues to expand, and BuildQapital is well-positioned to capitalize on emerging opportunities with our cutting-edge technology and market expertise.

Commitment to Innovation

Continuous investment in R&D ensures that BuildQapital remains at the leading edge of technology, driving future success and investor returns.

Have a question? Submit a Ticket.

RevolutionizeTrading Experience With Our AI and Blockchain Integration

Welcome to the future of tradung, where cutting-edge technology meets financial innovation. We present a groundbreaking AI-backed trading platform that puts the power of automated trading at your fingertips. Whether it's with retail traders, institutional investors, or a hedge fund, our platform accelerates trading strategy development, unlocking unprecedented high-frequency trading possibilities in the coming future of AI backed financial and blockchain technology.

The Synergy of AI and blockchain

Blockchain technology, a catalyst in the evolution of the internet of value, takes center stage in transforming automated trading and trading platforms. Our platform harnesses the potential of blockchain to create a seamless value in chain able to offer digital assets governed by smart contracts and represented by tokens. The decentralized and self-sovereign identity (SSI) features of blockchain eliminate intermediaries, ushering in a new era of efficiency and security. In other words, user funds stay in their complete control.

Enhanced interface

AI Backed algo-trading

Smart Contracts

Non-Custodial Wallets

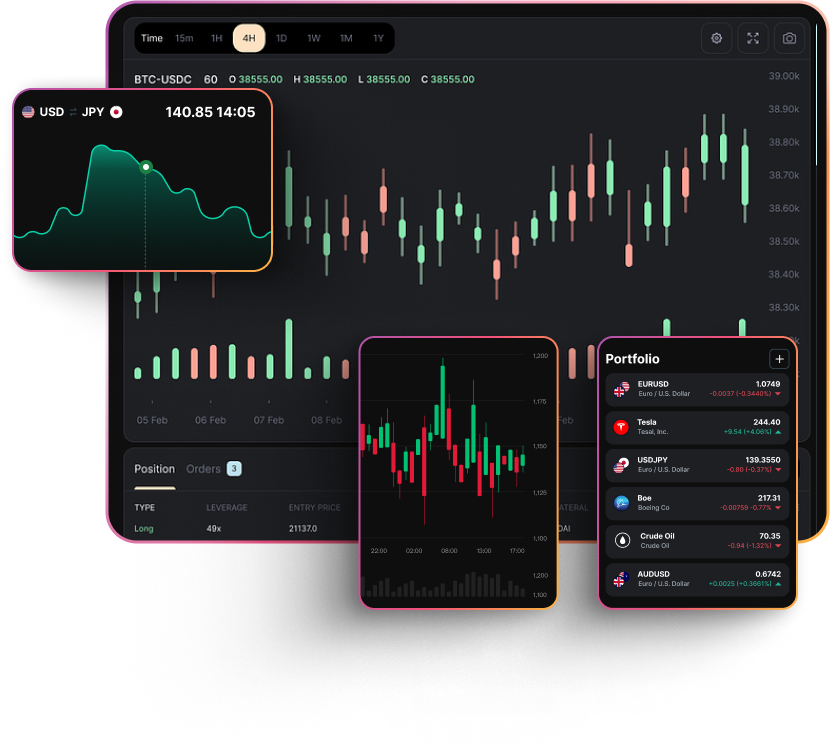

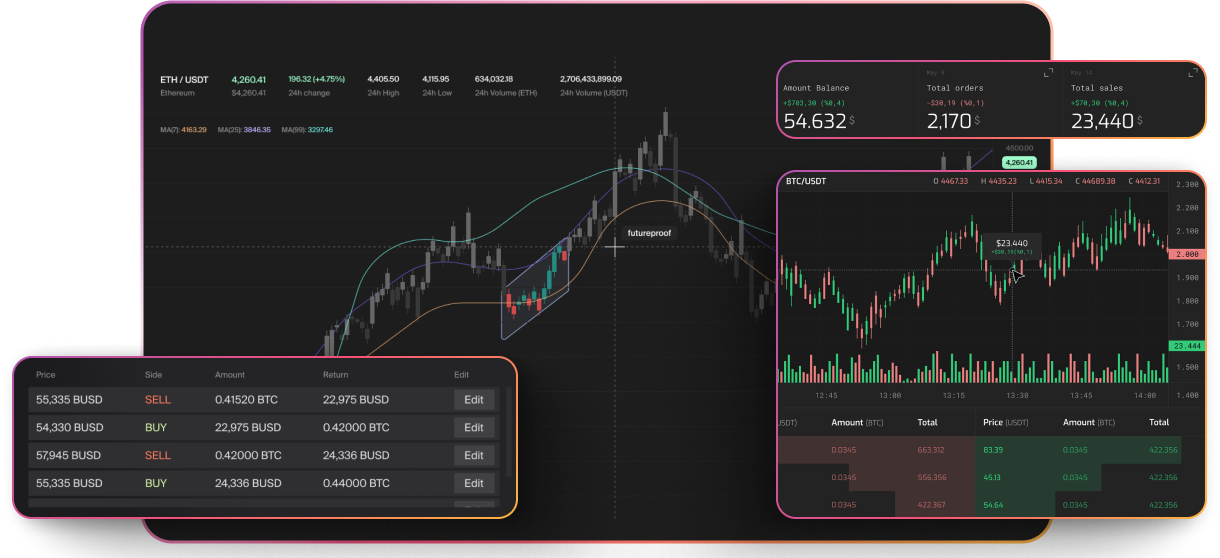

AI-Driven Automated Trading

With just a few clicks, our user-friendly platform allows you to build and deploy automated trading strategies effortlessly. Drag trading indicators and tools onto the chart, seamlessly automate them, and deploy them on any financial instrument. The result? massive high frequency trading possibilities, reducing development time, and maximizing profits for both institutional hedge funds, traders, and of course our trading platform.

Effortless Strategy Creation

Drag-and-Drop Features

Streamlined AI Automation

Multi-instrument Capabilities

High Frequency Trading

Short Development Cycle

Maximizing Profit Margins for Stakeholders

Referral System

Effortless Strategy Creation

Drag-and-Drop Features

Streamlined AI Automation

Multi-instrument Capabilities

High Frequency Trading

Short Development Cycle

Maximizing Profit Margins for Stakeholders

Referral System

Diverse Use Cases of Blockchain Technology

Empower users with control over personal data.

Utilize Self-sovereign identity (SSI) on the blockchain for secure decentralized identification. No more KYC verification waiting times.

Enable full traceability of assets, information, and people from creation to current state.

Enhance traceability with integration with external technologies like IoT. Reduced AML verification time.

Provide real-time transparency and immutability to reduce fraud risk.

Verify the legitimacy of transactions, luxury NFT’s and other tokens through NFC or QR code-based blockchain verification.

Automate predefined conditions with self-executing smart contracts.

Tokenization through smart contracts brings legal processes into programming, reducing the need for intermediaries. This will rapidly automate the back-end compliance and legal functions required to operate advanced trading platforms and systems.

Enable decentralized asset tokenization, certifying ownership transparently.

Non-fungible tokens (NFTs) gain popularity in commercializing digital creative works through the form of physical luxury assets (physical digital NFT paintings, Platform Cash/Debit Cards etc.). In the near future, these will become a primary tool used in various ways.

Join the Future of Fintech

Asset Management

- Identify signals

- Capture underlying relationships in big data

- Optimize operational workflows

- Risk Management

- Convergence of strategies

Algorithmic Trading

- Liquidity Management

- Enhance Risk Management

- Execution of Large Orders

- Optimize Order Flow

- Market Volatility

Blockchain Based Finance

- Smart Contracts

- Risk Management

- Support DeFi Applications

- Amplifies Risks of Decentralized Finance

AI Revolution

Crafting Tomorrow's Strategies Today

Algorithmic Trading

A cornerstone of modern financial markets, is undergoing a revolutionary transformation with the extensive integration of Artificial Intelligence (AI). From formulating cutting-edge trading strategies to executing trades autonomously.

Trading Strategy Formulation

AI-driven systems leverage evolutionary computation, deep learning, and probabilistic logic to suggest innovative trading strategies.

Hedge Funds

Algo wheels, a form of AI already used by hedge funds, introduces structured planning with “if/then” logic, providing a systematic approach to upcoming trades.

Benefits of Implementing Blockchain

Traceability and Trust

- • Ensure end-to-end traceability

- • Digital twins & unique identifiers

- • Foster trust through transparent and unalterable records

Security, Protection, and Control

- • Enhance risk management efficiency

- • Systematic controls

- • Proactively inhibit and identify security breaches with increased surveillance measures

Operational Efficiency and Competitiveness

- • Facilitate process improvements

- • Reducing administrative costs & efforts

- • Assure income collection in compliance with regulations, contributing to competitiveness

Integration and Interoperability

- • Foster document sharing and trust among stakeholders

- • Harmonize and standardize documents and processes

- • Promoting interoperability

Revolutionizing Trading Strategies: The World's First Code-Free Optimized Strategy Builder

In a groundbreaking leap for the financial industry, we've pioneered the world's first optimized strategy builder, pushing the boundaries of what's possible in automated trading. This cutting-edge tool empowers traders to craft intricate if/then statements seamlessly using visual indicator tools—eliminating the need for complex coding and transforming the entire trading process from A to Z into an effortlessly automated journey.

No Code, No Limits

Say farewell to the complexities of coding. Our innovative strategy builder allows you to create sophisticated trading strategies using intuitive visual indicators, making the process accessible to everyone, regardless of coding expertise.

Seamless Automation

We've streamlined the path from strategy conception to execution. With our optimized trading strategy builder, the once intricate and time-consuming process of coding is replaced with a seamless, automated experience, reducing the learning curve and boosting efficiency.

Visual Indicator Tools

Harness the power of visual indicator tools to define your trading parameters. No more deciphering complex lines of code—simply drag and drop, set your conditions, and watch as your strategy comes to life.

Efficiency Redefined

Experience unparalleled efficiency as our optimized strategy builder simplifies the creation of diverse trading systems and if/then processes that harness the power of ML and AI. Revolutionize your approach to trading without compromising on the sophistication of your strategies.

Innovative User Interface

Our user-friendly interface is designed with your convenience in mind. Navigate effortlessly through the strategy-building process, visualize your conditions, and execute with confidence, all within a single, intuitive platform.

Unleash Your Creativity

The world of trading is now open to your creativity. Craft, refine, and optimize your strategies without the limitations of coding expertise. Unleash the full potential of your ideas with a tool that adapts to your vision.

Optimized for Success

Achieve unprecedented success in the financial markets with strategies tailored to your unique insights. Our optimized builder ensures your trading rules are not just automated but finely tuned with adaptive AI and ML for maximum effectiveness.

AI in Highly Digitized Markets

Elevating Trading Practices to New Heights

Adoption, Market Cap, and Regulatory Challenges

The cryptocurrency landscape has experienced significant growth, with digital assets becoming a popular alternative asset class in the global economy. As of the end of 2021, the total number of global crypto users reached an estimated 295 million, indicating a substantial increase in adoption. The market cap of cryptocurrencies, at the time of writing in February 2022, is approximately USD 2 trillion, showcasing the industry's scale and influence.

Surging Towards A Crypto Dominant Future

The landmark Crypto.com analysis unveils a staggering climb to 295 million crypto enthusiasts globally by the close of 2021.

This monumental rise not only highlights the growing fascinations with cryptocurrencies across the globe but also signals a shift towards a future where crypto reigns supreme as the primary medium of monetary exchange.

Total Market Cap

The total market capitalization of cryptocurrencies is estimated at around USD 2 trillion, highlighting the overall value of the crypto market.

This valuation reflects the combined market value of various digital assets such as Bitcoin, Ethereum, and other altcoins.

Crypto Exchange Custody

Leading crypto exchanges play a crucial role in the industry, with the top 13 platforms collectively custoding USD 156 billion in cryptocurrencies as of January 2, 2022.

These exchanges serve as key infrastructure for users to trade, buy, and sell digital assets.

Prominent Crypto Exchanges

The 13 leading exchanges contributing significantly to crypto custody are: Coinbase, Binance, Huobi Global, Kraken, Okex, Gemini, Bitfinex, Bittrex, Bitflyer, Coincheck, Bitstamp, and Bybit.

These platforms have established themselves as key players in the crypto trading ecosystem.

Regulatory Challenges

Despite the industry’s growth, regulatory frameworks governing cryptocurrencies remain unclear or non-existent in many countries.

Some crypto exchanges operate without proper licenses, often incorporating in offshore jurisdictions to minimize regulatory oversight.

Lack of Clarity in Regulations

The lack of clear regulations poses challenges for both the industry and users, leading to concerns about investor protection, financial stability, and the potential for illicit activities.

Offshore Incorporation for Regulatory Arbitrage

To navigate regulatory uncertainties, some crypto exchanges opt for offshore incorporation, choosing jurisdictions with less stringent regulations.

This practice allows exchanges to operate with greater flexibility but raises concerns about transparency and accountability.

Cryptocurrency Security and the Significance of SOC 2 Certification

In the ever-evolving landscape of cryptocurrencies, security remains a paramount concern for users, investors, and service providers. Reputable crypto exchanges, custodians, and service providers understand the importance of investing significantly in their IT systems and security infrastructure. This commitment is driven by the industry's history of security breaches and hacking events, which have resulted in substantial financial losses.

Security Concerns in the Crypto Industry

The cryptocurrency industry has witnessed over 60 major security breaches and hacking events globally, leading to investor losses totaling USD 12.6 billion.

The prevalence of such incidents underscores the critical need for robust security measures within the crypto ecosystem.

Leveraging the Power of Hybrid Security: With our innovative fusion of decentralized blockchain technology and co-located cold storage solutions, we effectively insulate our users from the industry’s security funds breaches, ensuring client assets remain untouched and safe.

Role of SOC 2 Certification

SOC 2 (Service Organization Control 2) certification emerges as a pivotal factor in addressing and answering these security concerns.

SOC 2 certification serves as the industry benchmark for evaluating the effectiveness of a service provider’s information security controls.

Industry Benchmark in Security Measures

In recent years, SOC 2 certification has gained prominence as a standard for assessing the security, availability, processing integrity, confidentiality, and privacy of an organization’s systems.

It provides assurance to users that a service provider has implemented and maintained robust security controls.

Focus on Information Security

SOC 2 places a specific emphasis on information security, making it highly relevant in an industry where the protection of user data and assets is of utmost importance.

The certification demonstrates a commitment to meeting stringent security and privacy requirements.

Understanding SOC 2 Certification in the Crypto Space

SOC 2 (System and Organization Controls 2) certification is a critical framework for evaluating and ensuring the effectiveness of internal controls related to information technology within an organization. It involves a comprehensive audit process conducted by a certified public accountant (CPA) who issues an audit opinion. The SOC 2 report is prepared based on the Trust Principles, covering Security, Availability, Processing Integrity, Confidentiality, and Privacy.

SECURITY

Ensures that the system is protected against unauthorized access (both physical and logical).

01

AVAILABILITY

The system is available for operation and use as committed or agreed.

02

PROCESSIGN INTEGRITY

System processing is complete, valid, accurate, timely, and authorized.

03

CONFIDENTIALITY

Information designated as confidential is protected as committed or agreed.

04

PRIVACY

Personal information is collected, used, retained, disclosed, and disposed of in conformity with the commitments in the entity’s privacy notice.

05

Purpose of SOC 2 Report

– The SOC 2 report, with an audit opinion from a CPA, provides third-party assurance regarding the controls implemented by a crypto firm.

– SOC2 is a requirement for regulatory compliance and international regulatory bodies.

– It demonstrates how the crypto firm addresses security, availability, processing integrity, confidentiality, and privacy.

– By adhering to the Trust Principles, the report offers transparency into the effectiveness of the organization’s internal controls.

AICPA Criteria and Independent Assessment

– The American Institute of Certified Public Accountants (AICPA) provides general criteria for the effective design of controls under the Trust Principles.

– The independent assessor, usually the CPA firm conducting the audit, identifies and evaluates the controls implemented by the crypto firm against these criteria.

Building Confidence in Service Delivery

– SOC 2 certification is instrumental in helping crypto firms build confidence in their service delivery processes and controls.

– The third-party assurance report assures customers, business partners, investors, and regulators that the organization has robust controls in place.

Scope of SOC 2

– Unlike SOC 1 reports that focus on internal controls over financial reporting (ICFR), SOC 2 reports concentrate on controls relevant to the Trust Services Criteria (TSC).

– TSC, established by AICPA, cover security, availability, processing integrity, confidentiality, and privacy.

– The scope of SOC 2 is broad, encompassing the entire organization’s systems and processes that handle customer data and sensitive information.

Distinction Between Type 1 and Type 2 Reports

Type 1 Report

Coverage: Type 1 reports focus on the design and implementation of controls at a specific point in time, providing a snapshot of the controls in place.

Timeframe: It reflects the state of controls at a particular moment, offering a point-in-time assessment.

Scope: Type 1 reports do not assess the operating effectiveness of controls over a period but evaluate their design adequacy.

Snapshot: This report is like taking a photograph, capturing the controls’ existence and design at a specific date.

Type 2 Report

Coverage: Type 2 reports cover both the design and operating effectiveness of controls over a specified period, typically a minimum of six months.

Timeframe: It provides insights into how controls operate and perform over time, offering a longitudinal assessment.

Scope: Type 2 reports assess the controls’ effectiveness in addressing the Trust Services Criteria over an extended duration.

Continuous Evaluation: This report is akin to a video, showing how controls function over an extended period, including any changes or adaptations.

Distribution and Stakeholder Considerations

Availability to Stakeholders: Both Type 1 and Type 2 reports should be available for distribution to existing or potential customers and other stakeholders with expectations regarding the firm’s IT controls.

Building Confidence: A typical journey involves starting with a Type 1 report. This initial report helps instill confidence in external stakeholders about the firm’s commitment to IT systems and cybersecurity.

Remediation and Transition: If concerns or deficiencies are identified in the Type 1 assessment, the crypto firm can address them before transitioning to a Type 2 report. The Type 2 report, with its higher standard, showcases the remediation efforts and the operating effectiveness of controls.

Typical Journey from Type 1 to Type 2

Year One – Type 1 Report: A crypto firm might begin with a Type 1 report in the first year. This helps establish trust and confidence in the initial state of IT controls and cybersecurity measures.

Remediation and Improvements: Based on the findings of the Type 1 assessment, the firm can remediate concerns and make improvements to enhance controls.

Transition to Type 2 Report: Subsequently, the firm can transition to a Type 2 report. This report demonstrates the sustained effectiveness of controls over time and incorporates any enhancements made post-Type 1 assessment.

Higher Expectation Standard in Type 2

Enhanced Assurance: Type 2 reports are considered to provide a higher level of assurance because they not only evaluate design but also assess the ongoing effectiveness of controls.

Continuous Monitoring: The Type 2 report’s coverage of a specific timeframe allows for continuous monitoring and evaluation of controls, aligning with the evolving nature of cybersecurity threats.

In summary, the choice between SOC 2 Type 1 and Type 2 reports involves consideration of the desired depth of assessment. Starting with a Type 1 report and progressing to a Type 2 report is a common and logical sequence, allowing organizations to build confidence, address concerns, and demonstrate continuous improvement in their IT controls and cybersecurity measures.

The process

BENEFITS OF PERFORMING SOC 2 REVIEW

Safety & Security

Integration

Efficiency

Governance

Attraction

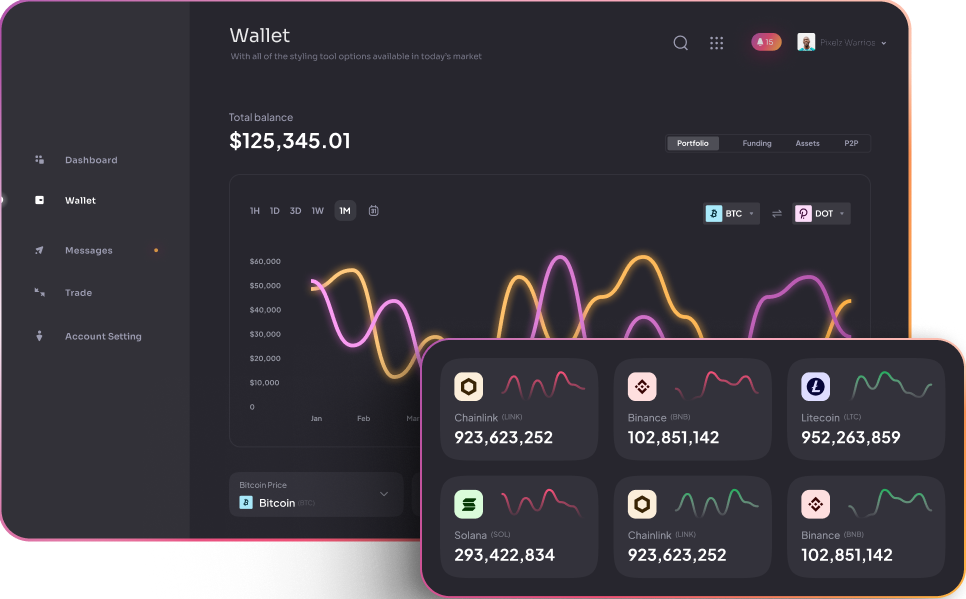

Non-Custodial DeFi Wallets Empowering Crypto Users

Decentralized Finance (DeFi) has brought about a significant transformation in the realm of blockchain and cryptocurrencies. DeFi facilitates cross-border payments and offers lucrative income opportunities on a global scale. At the core of this financial revolution is the decentralized crypto wallet, a fundamental tool for securing and managing digital assets.

Why Safeguarding Crypto Money Matters

Since the early days of blockchain, digital currencies like Bitcoin and Ethereum, as well as crypto assets such as NFTs and tokens, are stored in decentralized crypto wallets.

These wallets are secured by private keys, granting users exclusive access and control over their cryptocurrencies.

Overview of DeFi Wallets

DeFi Wallets serve as the backbone of the DeFi ecosystem, enabling users to engage in various financial activities within a decentralized and permissionless framework.

While many DeFi wallets are built on the Ethereum blockchain, the expansion of DeFi has led to the development of wallets on multiple blockchain platforms.

Private Key: The Key to Control

DeFi wallets are accessed using private keys, also known as ‘secret keys,’ which are cryptographic numbers used for data encryption and decryption.

The private key acts as a crucial tool, allowing users to unlock their wallets and manage funds securely.

Types of DeFi Wallets

Custodial Wallets

– Managed by third-party custodians who hold the private key.

– Users rely on custodians to access and manage their crypto assets.

– Risks include potential data breaches, freezing of assets, and lack of direct control.

Non-Custodial Wallets

– Private keys are in the hands of wallet owners, ensuring complete control.

– Users have full responsibility for the safety and security of their funds.

– Risks include the possibility of losing access if private keys are forgotten, malware attempts, and potential theft if private keys are stolen.

Comparing with Traditional Crypto Wallets

– DeFi Wallets empower users to be their own banks, providing complete custody of funds.

– Users can access their digital assets using private keys, and KYC is not mandatory for all DeFi wallets.

– DeFi wallets offer seamless integration with various DeFi platforms and exchanges, providing more versatility compared to traditional wallets.

Core Components

DeFi Wallets

Non-Custodial Nature

- Full Ownership

- Private keys

Storage of All Crypto Assets

- Can hold various crypto assets

- Including coins and dApp tokens

- Smart Contracts

Ease of Swapping

- Smooth token swapping

Compatibility

- Numerous Crypto Platforms

- Crypto Exchanges

Secured Transactions

- Private keys

Decentralized Crypto Wallets, particularly Non-Custodial DeFi Wallets, empower users with control, security, and versatility in managing their crypto assets. The adoption of DeFi wallets reflects the broader shift towards decentralized and user-centric financial systems.